- The Sindh Revenue Board (SRB) has authorized 58 restaurants and hotels in Karachi to collect a 15% Sindh Sales Tax (SST) on digital payments, up from the previously reduced rate of 8% that was initially introduced in the fiscal year 2024-25 to encourage economic documentation.

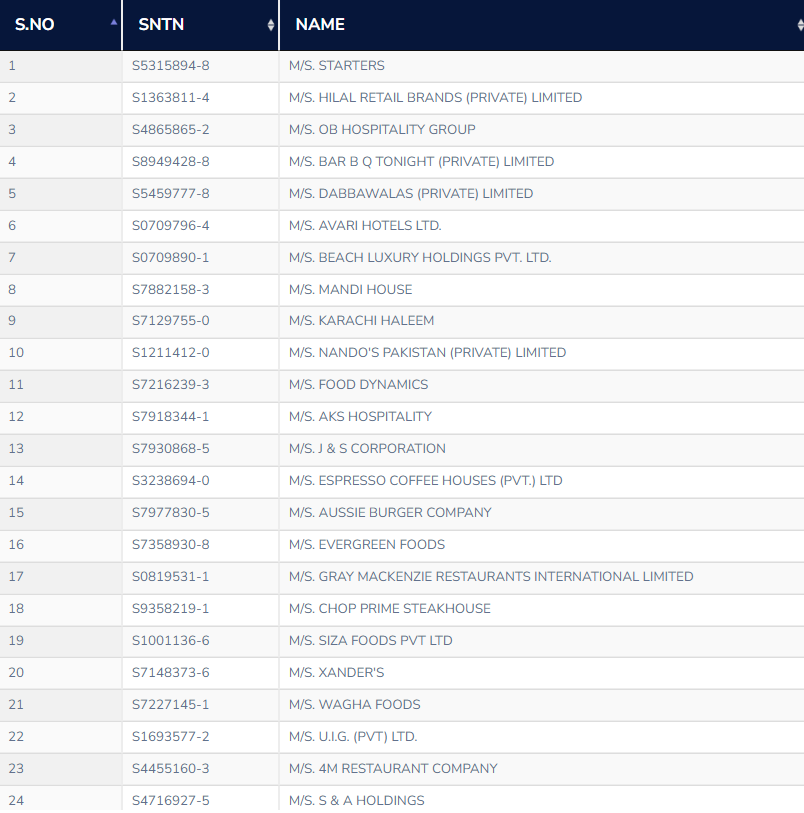

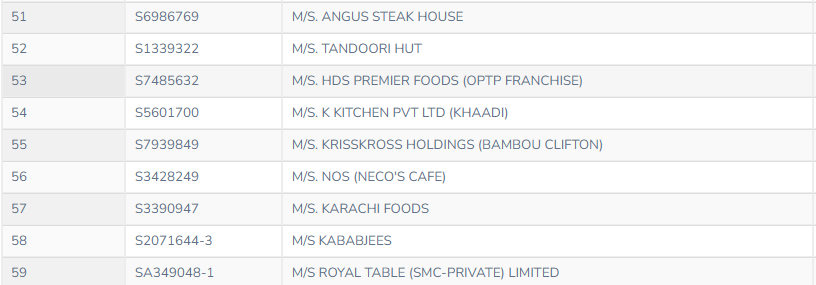

- Only restaurants with a Point of Sale (POS) system integrated with the SRB are eligible to collect the 15% tax. Out of over 1,700 registered restaurants, only 58 have received permission to apply this higher tax rate, primarily targeting larger establishments with significant market shares.

- The SRB clarified that the reduced 8% tax rate for digital payments has not been withdrawn and remains applicable for restaurants that have not opted for the 15% rate. Customers are advised to verify the applicable tax rate before dining by checking the SRB website or requesting confirmation from the restaurant.

The Sindh Revenue Board (SRB) has approved a service tax increase for 58 restaurants and hotels in Karachi, allowing them to charge a 15% tax on digital payments. This new rate, which is almost double the previous 8%, effectively removes a prior incentive meant to enhance economic transparency and documentation.

As outlined in the Sindh budget for the fiscal year 2024-25 (FY25), the Sindh Sales Tax (SST) on services provided by restaurants was initially lowered from 15% to 8% for payments made via debit and credit cards. However, the SRB has now given select restaurants the green light to revert to the 15% tax rate, focusing on adjusting input tax payments for these establishments.

According to an SRB notification, only restaurants equipped with a Point of Sale (POS) system can impose this 15% tax. While there are hundreds of thousands of eateries in Sindh, only 1,700 of them—mostly in Karachi—are registered with the SRB. Out of these, high-end restaurants form a small group.

Tax professionals have pointed out that permission to levy this higher service tax has mainly been granted to larger restaurants with a significant market share.

The SRB’s announcement confirms that, as of now, only 58 out of the more than 1,700 registered restaurants have been approved to charge the 15% service tax. These establishments must have POS systems integrated with the SRB and comply with the Sindh Sales Tax on Services Act, 2011, to qualify.

Also Read:

IFC Backs i2i Ventures, Pakistan’s First Female-Led VC Fund with $3 Million

This change is part of the SRB’s revised 2024-25 tax year tariff, following the amendments made in the provincial budget 2024.

The revised tax regulations apply to all restaurant services, including those provided by hotels, motels, guest houses, and farmhouses.

Recently, several media reports claimed that the SRB had rescinded the reduced tax rate for all Karachi restaurants, leading to confusion among the public. In response, the SRB released an official statement clarifying that these claims were inaccurate and potentially aimed at misleading customers.

The SRB emphasized that the reduced tax rate on services for digital payments, including debit cards, credit cards, mobile wallets, and QR code scanning, has not been revoked but remains in place.

For restaurants that choose to charge the standard 15% SST even on digital payments, special permission from the SRB is required as per rule 42(1)(b) of the Sindh Sales Tax on Services Rules, 2011.

Additionally, the SRB advised customers to verify the applicable SST rate before dining out. They can do this by checking the SRB website or requesting written confirmation from the restaurant itself.

Stay tuned to WOW360.